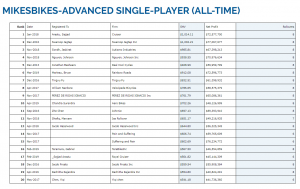

Meet Sajjad Husain Arastu, a Master’s student in International Business from The University of Auckland. He is currently sitting in first place in the Top 20 MikesBikes Advanced Hall of Fame. His $1,014.11 Shareholder Value has been unbeatable for two consecutive years now. Since then, he has been consistently trying to beat his own record. This reminds us of a saying from a Canadian based philosopher and entrepreneur, Matshona Dhliwayo:

“To be a champion, compete; to be a great champion, compete with the best; but to be the greatest champion, compete with yourself.”

The article below is written by Sajjad. Let’s get to know him more as he shares his MikesBikes Experience with us.

The beginning of my journey

I’m Sajjad Husain Arastu. I’m from India. I came from an engineering background specializing in Marine Engineering. I was fortunate to get an education in top universities in three different countries namely: India, Malaysia and New Zealand.

Coming from a technical background, I soon realized that the main decision-making ability lies with people who understand business. This motivated me to come to New Zealand and pursue a Master’s in International Business. I wanted to expand my knowledge further, learn the commercial aspects of business and to grow in the industry. The purpose of selecting this course was to gain deep knowledge on the commercial side of the International Business – focusing on International Trade, Logistics, Global Operations and Consultancy. In addition, I also wanted to gain skills in managing people, operations, research and development, planning and strategy in complex business environments.

MikesBikes Experience

My first course in this program was Managing People and Organisations, which introduced me to MikesBikes Advanced. It was the most exciting part of my learning. I want to thank Professor Darl Kolb for teaching this course and giving us the ability to run our own companies.

When I was doing my Marine Engineering course, I had an experience using a simulation to design ships and learn how to calculate. I never knew that we could run a business using a simulation.

The idea of using a business simulation was very new to me. I wanted to try and understand it in order to help me make decisions in a real business. I came from a technical background with literally no experience in business, so it was tough for me to understand the different business functions.

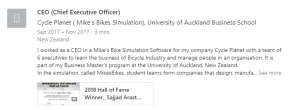

We first tried the single-player version for a week and then progressed to form our teams, where we managed our companies in the multi-player version. I was selected as the CEO of my company, Cycle planet, because I managed achieve a Shareholder Value (SHV) of $200 in my single-player version.

Competing against our friends and running my own company was one of the most thrilling experiences for me. The MikesBikes Advanced simulation is a perfect combination of the human-machine interface, which makes use of technology to develop human thinking. This motivated me because, it was exciting as every decision is unique and brings a different outcome. It also gave me an ability to manage and learn from people by competing against their companies.

Invitation to MikesBikes World Champs

The best thing happened to me towards the end of the quarter. Smartsims sent an invitation to participate in the MikesBikes World Champs. I got excited because we were just playing among our friends and classmates, and now I’m given an opportunity to compete against other students from all over the world. I wanted to experience this and develop my understanding further, so I participated in the world championship.

In the world champs, there was a condition where we could not design more than two R&D (Research and Development) projects in a given year. This was something different from the scenario we do in the course. It required a new set of decisions and more strategic planning. My team and I made some mistakes with our strategy and our group ended up in the Top 14 worldwide, which was not bad but gave me more motivation to learn and master the simulation.

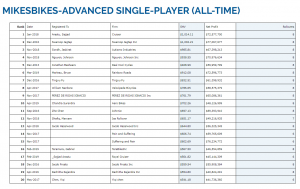

My Single-Player Journey to First Place

Using MikesBikes for around 10 weeks in the course honed my learning and understanding of business. I was also becoming more familiar with the simulation. After every rollover, I look at the Hall of Fame ranking. I wondered how people could get such high scores and what they did differently.

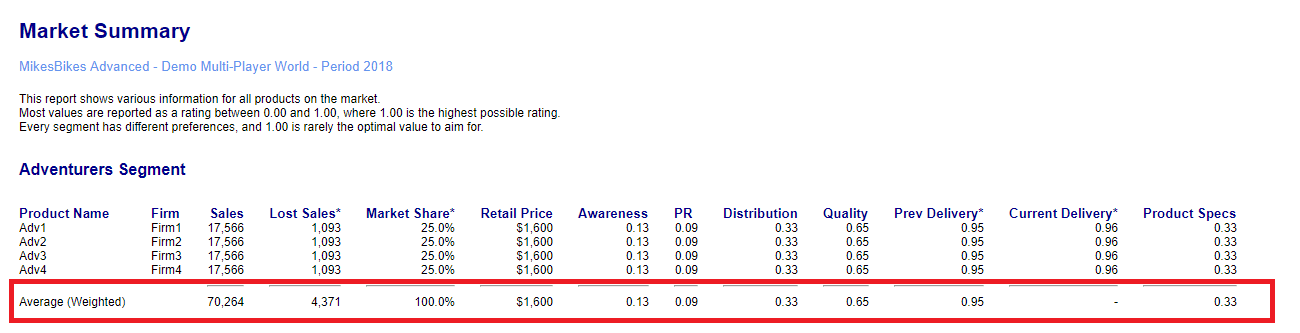

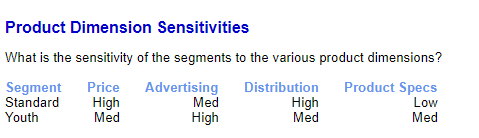

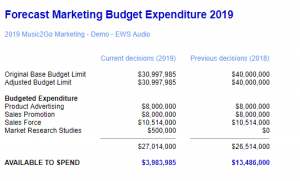

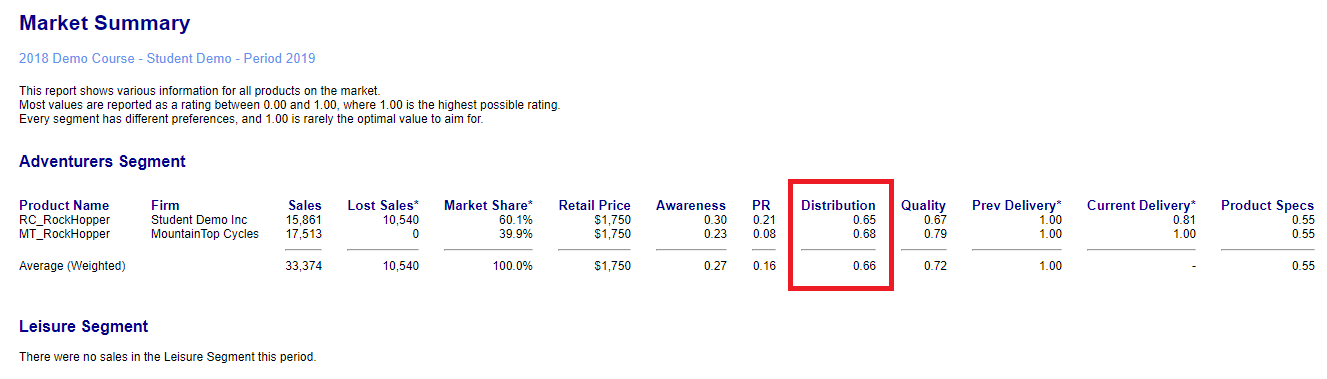

After joining MikesBikes World Champs, I decided to play with a target of getting in the Top 20 Hall of Fame. Since I have a technical background in marine engineering, I started to think like an engineer than a business person. I started optimizing my decisions to generate more profit. As soon as I realized I’m spending too much money, I needed to minimize my cost in all aspects of my planning and came up with a new strategy to enter the Hall of Fame. I tried and looked at my decisions very carefully and started optimizing my R&D, Operations and Marketing spend.

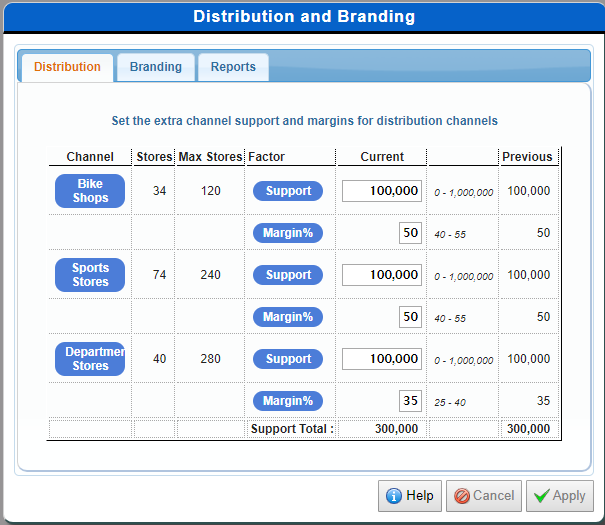

As an example, in my initial rollover, the cost of making one Adventurer bike inclusive of all costs was close to $260 which I optimized to as low as $97. This increased my profit margins. Additionally, I also adjusted my Operations, Advertising, Distribution and Finance decisions to reach a Shareholder Value (SHV) of $1,022 with an overall net profit of $73 million which landed me the top spot in the Hall of Fame.

Impressions on the simulation

When I was first using the simulation, I thought it is just like a game. However, that was not the case. I noticed that every aspect of the simulation is interrelated and it requires strategic planning in aspects such as R&D, marketing and operations. It also involved a lot of teamwork, because we make decisions that involve a lot of planning and some calculations. Some of the decisions in my initial rollovers were just based on trial and error. However, as the course progressed, they became more planned, calculated and forecasts were made more accurately. Working well in your teams is one of the keys to succeed in the simulation.

Value and impact of the simulation in my learning

I got a chance to work with a diverse group of people. I also realized that interaction with your team is necessary in order to share ideas with each other. Every member of the team has specific duties, which is essential to make collective decisions.

In MikesBikes, our firm needed to maintain profitability in order to increase our Shareholder Value over time. This can be achieved by proper planning, understanding the components of business functions and making informed decisions.

One of the main challenges we faced as a team revolved around making the right decisions as some of our members were not aware of some of the concepts. This created misunderstanding among us when analyzing the reports. Our main priority as a team was to learn and understand our roles and duties to strengthen our relationship with each other. To improve on this, we kept a record of all our previous decisions so that we can focus on modifying these and to achieve better results. In MikesBikes, we are dealing with competitive markets which were hard to predict. Every decision required a large amount of funding.

MikeBikes provided us with a very realistic platform, which is an essential part of my learning and development. As an individual and also as someone that’s part of a team, the simulation gave me an insight in every aspect of the business. It also gave me an understanding of the value of money and how to avoid overspending to maximize our output. The simulation has helped my development in the university.

I want to thank Professor Darl Kolb for always encouraging and motivating me to develop my learning in the simulation through his weekly stock reports. This report showed us how we are doing in class against our competitors.

Advice to my past self

If I were to go back and play the simulation again, I would improve and optimize my pricing and financial decisions. I have not not mastered these aspects yet. As an example, if I keep my prices too high, my competitors will take the market share by offering low prices. Additionally, if I drop my price, I will miss out on potential profits. I need to find balance between pricing my products and knowing when the best time time is to make financial decisions.

Using my MikesBikes Experience in LinkedIn

I want to be an expert in my field and want to grow in the industry. I worked day and night using MikesBikes to develop my learning and understanding of business. I think in this competitive environment, it is necessary to do something different and stand out in the eyes of employers by showing your potential.

I used LinkedIn to demonstrate potential employers that I have great abilities and skills, which I developed over time and would be a great asset to them if they provide me with an opportunity to work with them. It has been eight years till date, and my struggle to find a full-time job has pushed me beyond my comfort level to grab any opportunity to show employers my potential and worth. I believe LinkedIn can market my achievements to the world of employers.

Connect and get to know Sajjad: