“Don’t be afraid to ask questions. Don’t be afraid to ask for help when you need it. I do that everyday. Asking for help isn’t a sign of weakness, it’s a sign of strength. It shows you have the courage to admit when you don’t know something, and then allows you to learn something new.”

– Barack Obama

Here are the top three questions that students asked from the last two MikesBikes Introduction Q&A sessions we held recently. If you have missed the sessions or would like to review the questions asked, you can view the posts through our Facebook page here.

Question #1

What would you say is the biggest challenge that we will face and how should we deal with it?

The “biggest challenge” differs with each firm, but there are a few common challenges students will face:

- Excessive Inventory or Lost Sales

Both of these scenarios are caused by inaccurately forecasting your firm’s sales for the year ahead. Ideally a firm would want to minimize this by correctly forecasting sales and adjusting your production based on this forecast (while also taking into account existing inventory levels).

There is a very helpful video available that demonstrates how to Forecast Sales within MikesBikes Introduction for new and existing products. Click here to view the video.

- Not paying attention to consumer preferences.

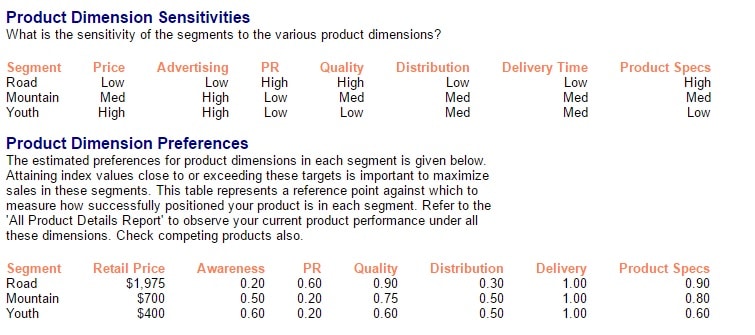

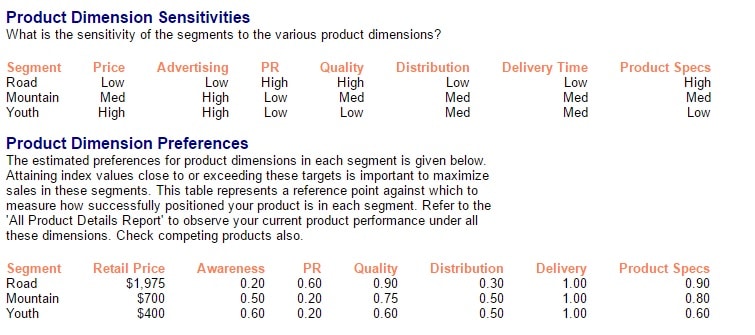

It is crucial that your Product Strategy follow the preferences of your consumers. Valuable Market Research has been conducted to investigate what your customers are looking for in the products they buy. This information is available to you under the Market Information Report (under the Key Reports menu).

The table above (taken from the Market Information Report) will tell you important areas that you should be focusing on. For example, the Mountain Segment has High sensitivity to Advertising. What this means is you should be focusing your Marketing Budget on Advertising and not PR (as the Mountain segment has low sensitivity in this area). If a market segment is highly sensitive to one area this means: “if you increase this figure, then proportionately more people are going to buy your bike.” This would then result in a higher return on your investment than if you invest in areas where your target market segment has a low sensitivity in.

- Incorrect Pricing Strategy

Students make a mistake on pricing their products too high without the increasing demand and their Sales Revenue starts to suffer. Contrary to that, some may also enter into a pricing war and priced their products too low resulting in difficulty covering costs.

When a situation like this arises, you will need to assess where your products are situated in relation to consumer preferences and your competitors. The best report to look at would be the “Market Summary Report” and identify if your product has low Awareness, low Quality or low Delivery (or all of the above) in comparison to your competitors. If they do, you should price your product at the lower end of the market. If not and demand for your product is still average to high, then you can price your products at the higher end of the market. Keep in mind that extreme prices, high or low, will have a negative effect on Gross Margins.

Question #2

In the fourth period, we’ll be given the option to launch a new product and modify our existing product. Is it better to remodel an existing product or launch a new product?

This depends on what your team decides to be more valuable to your strategy.

Essentially, when looking at launching a new product you will need to ask yourself the following questions:

- How big is the market for this product (Check the Market Information Report)?

- How many existing competitors are in there?

- Are we expecting any new entrants into this segment in the upcoming rollover? If so, what do we anticipate their market share would be?

- How many bikes would we anticipate on selling?

- Taking into account of the above, how much would we spend on marketing to enter the market?

- Based on our effective number of sales in the segment, what do we anticipate our profit to be?

You can then compare this potential profit against the potential profit gained from modifying your bike.

In remodeling your existing bike, you will look at things like:

- Are we remodeling to reduce costs or improve Technical Specifications (or both)?

- If we want to reduce costs, is the $1 million modification cost outweighed by the profit gained in the reduction costs?

You can calculate it as:

Old Production Costs – New Production Costs x Number of bikes you anticipate you will sell

- If you want to update the Technical Specifications, look at the Market Information report to see how sensitive the market segment is to changes in that? If it is High, then getting closer to the Ultimate Technical Specifications could result in significant increases in demand for your product (depending on how far away your product is from that desired technical specifications).

- How do anticipate this impacting our sales?

Once your team has looked at those two things (new bike versus modification) then you can decide, “Okay, which is more valuable to us right now? Can we afford that? Could we afford both? Or neither?” You can then evaluate your Cashflow Report for your Ending Cash Balance from the previous year.

Question #3

What is the best strategy to implement to get the best return in Distribution?

The best strategy is to look at the Distribution Summary report (see the table below for what this might look like) and analyze where your customers shop. Once you have identified this, place more emphasis on your Retailer Margin and Extra Support in those Distribution Channels.

It is also important to keep in mind here that the more a distributor profits from selling your products, the more likely they are to stock your product in upcoming years. That means they consider things like your Price, Sales Volume, Retailer Margin and Extra Support. However, be careful not to eat so much into your own products.

If you have any questions, please feel free to click here and fill out a form or email us at help@smartsims.com.