Corporate takeovers is an optional feature in the MikesBikes Advanced simulation which may be enabled by your course instructor.

This optional module gives student-run companies an opportunity to invest in other companies in their industry, as well as facilitating higher performing companies to mentor those who may be struggling.

Purchasing a Company

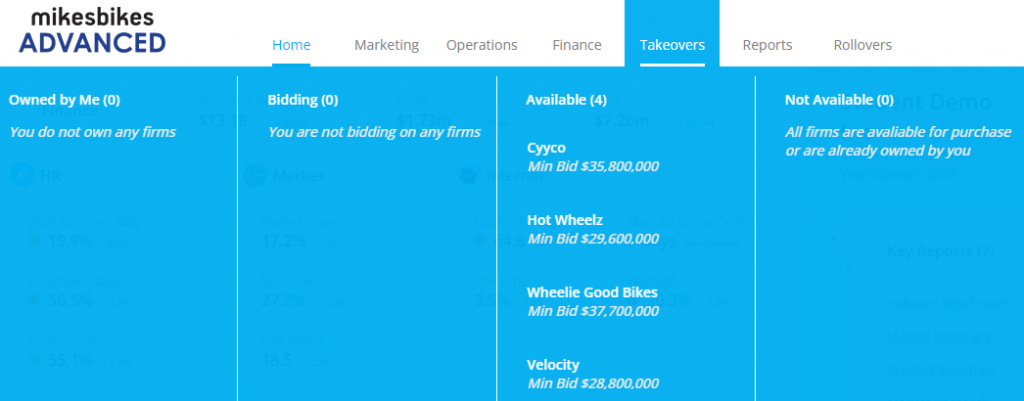

If this feature has been enabled by your course instructor a new Takeovers menu will

appear at the top of your screen. This menu displays the companies available to bid

on, which you have already bid on, which are owned by you, and which are

unavailable for purchase:

Purchasing an available company requires you to make a bid to all current

shareholders to purchase their shares and become the company’s sole owner.

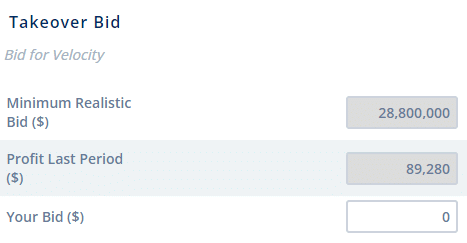

Selecting one of the available companies on the Takeovers menu takes you to the Takeover Bid screen:

The right-side of the Takeover Bid screen lists financial reports for the target company

so you can dig deeper into their current and past financial position.

All bids are processed at the rollover and results can be viewed through the Takeover

menu. If successful, you will make the financial decisions for the owned company, its

value will feature on your company’s balance sheet, you can pay yourself a dividend,

and its share price will be added to your company’s own. This enables you to not only

purchase an asset, but the opportunity to work with another company to help them

grow, and in doing so, improve your performance too.

Note: The owned company retains control of all non-finance decisions.

Will My Bid Be Successful?

A successful bid is one that:

- Is at least the minimum bid amount;

- Is the highest bid (if there are competing bids); and

- Does not breach Securities Commission Rules.

How is the minimum bid calculated?

The minimum bid is the market value (current market capitalization) of the firm plus

a 40% premium to ensure you attract sufficient interest to acquire all current shares.

For example, if Firm A has 2 million shares outstanding at $50 per share, then its

current market capitalization is $100m. The minimum realistic bid for Firm A would

be $140m.

This $40m premium will appear as a one-off charge on your Income Statement. Be

aware that this premium may cause you to record a large loss but keep in mind it is

a one-off charge.

Note: You may wish to bid higher than the minimum to beat other potential bidders.

What are the Securities Commission Rules?

Regulations exist to protect competition in the bicycle industry by ensuring that one

company does not have a total market share of greater than 50%. As such, you will

not be able to make a takeover bid for a firm where the purchase breaches this rule.

You will see these firms listed under the Not Available heading on the Takeover menu.

However, it is possible to get complicated ownership chains where Firm A owns B

who owns Firms C and D, provided that the Anti-Trust limits are not violated.

For more see: Takeover Rules and Regulations (also available within the Takeover

decision screens).

Impact on your Company’s Share Price

The share price of a parent company (the owner) is boosted by the share price of the

subsidiary (owned company) and subsidiaries are treated as non-operating assets for the purposes of valuing a parent firm.

This contribution to the parent company’s share price is:

Subsidiary Market Capitalization / Parent Number of Shares Issued

For example, if Firm A owns Firm B and:

- Firm A has 100 shares with an underlying Share Price of $50

- Firm B has 50 shares with an underlying Share Price of $40

Firm B’s contribution to Firm A’s Share Price is: 50 * $40 / 100 = $20

Meaning Firm A (parent) will have $20 added to their share price.

ie. Firm A Share Price = $50 + $20 = $70

Once you own a company you become responsible for all their finance decisions.

Select the company you own through the Takeovers menu to make these decisions.

Owner (Parent Company) Decisions

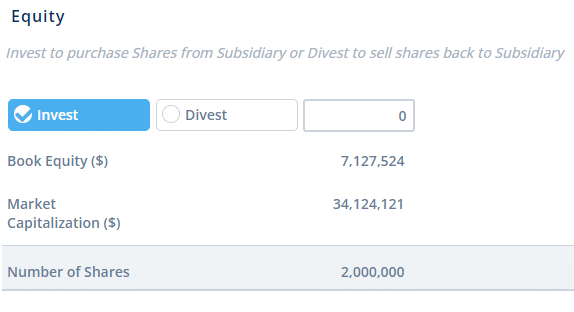

Equity

Increase or decrease your equity holding in the owned firm by purchasing shares

from a share issue or selling shares back as a share buy-back. Enter the value of the

shares you wish to purchase or sell back.

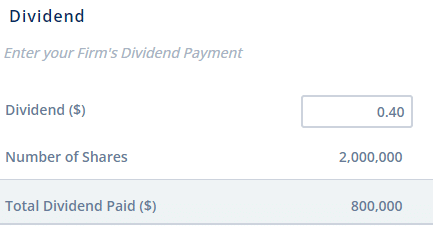

Dividend

Set an annual amount to be paid to shareholders as a cash payment.

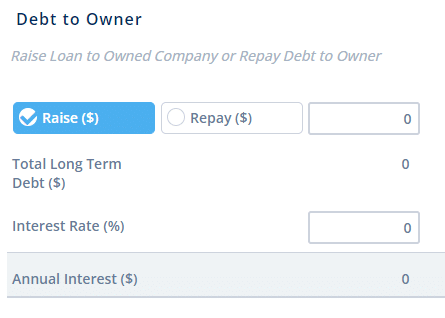

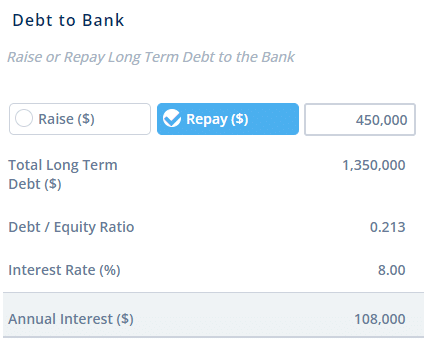

Debt to Owner / Debt to Bank

Your subsidiary may require additional cash which can be sourced from either the

parent company or the bank.

If you are unable or unwilling to continue to lend to a struggling subsidiary then you

should cut your losses and sell your shareholding.

The Debt Equity Ratio determines how much banks are willing to lend to your

subsidiaries.

Selling a Subsidiary

You may sell the entire company back to the share market at large by choosing your

subsidiary from the Takovers menu, and then clicking the Sell Firm button at the

bottom left of the screen.

- The sale price is based on the share price of the subsidiary at the end of the

period in which you choose to sell. - This process takes a year. Any decisions you make for your subsidiary during

the sale period will be void. - Any loans outstanding when you sell your subsidiary will be written off as bad

debt. Debt to bank is unaffected.

What if it’s my company that’s been purchased?

You remain the managers of your MikesBikes company and retain control of all

decisions except those under the Finance menu.

It is up to you whether you treat their purchase of your company shares as a merger or a hostile takeover. The company who has purchased your shares often has been more successful thus far. If you treat this as a merger this can be a great opportunity for you to work together to improve your company’s performance as your improved performance feeds into their Share Price. So, we recommend discussing a partnership in where they can assist you with strategy and possibly invest further capital into your company (through a loan) to help your strategic position.