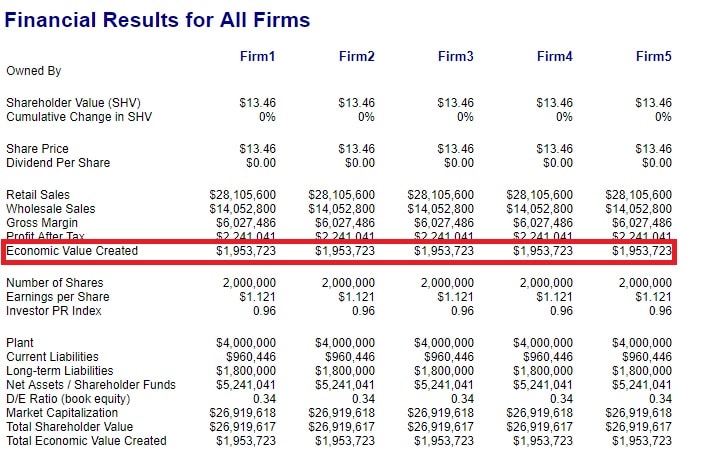

An increasingly popular way of measuring the financial performance of a firm is by looking at the Economic Value Created (often called EVA*) over a specified time span. See the Financial Reports section of the All Reports Menu for the firm’s current Economic Value Created report.

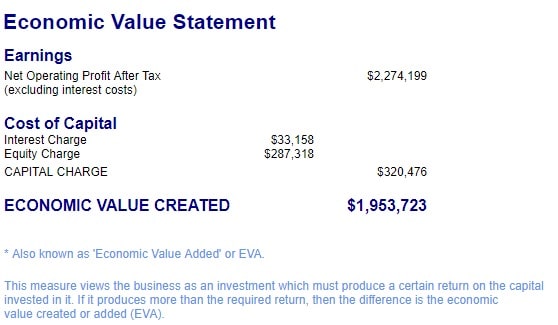

In essence, this measure views the business as an investment which must produce a certain return on the capital invested in it. If it produces more than the required return, then the difference is the economic value created or added (EVA).

The “actual return” is calculated by adjusting the net operating profit after tax to exclude the effects of interest.

The “required return” (or cost of capital) is calculated by adding together the interest charges on debt with the return required by the shareholders. The return required by the shareholders will vary according your firm’s level of risk and will be composed of required dividends and/or increases in share price.

If the actual return is higher than the cost of capital, then the difference is the economic value created. From an economic viewpoint this extra return must be due to some competitive advantage. The question is: How long can this competitive advantage be maintained before competitors come along and copy it?

An example of a simple EVA report is below:

Notes:

*EVA is a registered Trademark of Stern, Stewart & Co.