Winning the MikesBikes Business Simulation requires your management team to develop a long-term strategy. As in real life, if you bounce around with your decisions you will incur extra costs without additional benefits. In the section on the Strategic Management Process, we outline the process of developing and implementing strategy.

In the 1980’s, Michael Porter (of the Harvard Business School) did considerable work in defining three types of strategies that “fit” a business unit into its environment. These are called differentiated, cost and focus strategies. These are especially pertinent in the MikesBikes-Advanced scenario. For further information see Michael Porter’s Ideas on Strategy.

Developing and Implementing Strategy

The Strategic Management Process

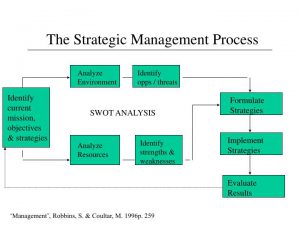

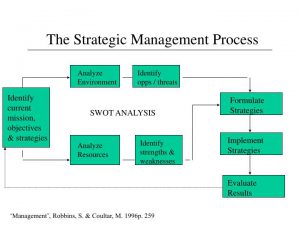

Making consistent decisions for a firm in all aspects of its operations is difficult without a well defined and clearly integrated strategy. The diagram below summaries a cycle which is sometimes helpful in developing this.

Analysis

The first stage in developing a strategy is analysis. A management team should consider both its internal and external environment.

External Analysis: A firm should look at the opportunities and threats in its external environment. This should include a sound analysis of customer needs such as physical attributes, quality, delivery and costs and also the actions of its competitors.

Internal Analysis: A management team should also consider a firm’s own competencies and resources. This may include looking at where the firm is currently positioned, its strengths in terms of quality and delivery and its financial resources.

Synthesis

This relates to pulling together all the data from the analysis phase and determining a strategy. It can be broken up into distinct functional areas, but in reality there is considerable overlap among them and much iteration occurs.

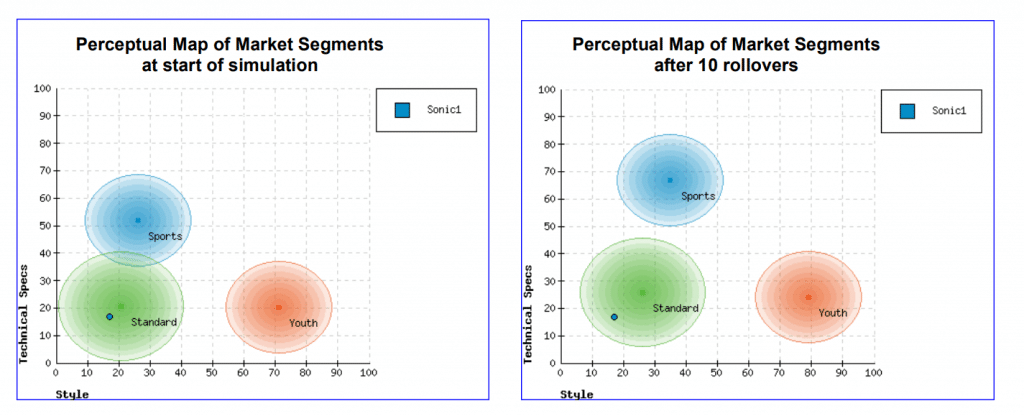

Creating Marketing Strategy: Having completed external and internal analysis, a management team should be able to develop a marketing strategy. An important step in this involves the decision whether to compete in one narrow segment or broadly in several segments. Then the selection of a specific segment or segments allows customer needs to be defined. Once these are defined a firm can begin to implement marketing decisions in areas such as distribution channel selection, price, advertising and production volumes.

Creating Manufacturing Strategy: A manufacturing strategy should be defined in conjunction with marketing strategy. Strategic decisions may include whether to produce a low cost product, or to try and differentiate it with features and to charge a premium for this.

It also includes making decisions to provide sufficient capacity to produce at the required volumes. It also requires producing goods with the appropriate quality level, delivery speed and cost to meet the needs of target segments.

Creating Financing Strategy: After both the marketing and manufacturing strategies have been defined, the financing strategy can be developed to provide the necessary finance to support investments required by the marketing and manufacturing strategies. The debt/ equity ratio can also be adjusted to balance the risk in the rest of the firm’s operations.

Iterating Strategies

While the process outlined above follows clear sequential steps it is obvious that in reality these are interrelated. Thus it is important reconsider each of the strategies to ensure that the marketing strategy does not make demands beyond the capabilities of manufacturing and that neither the manufacturing or marketing strategies require investments beyond the firm’s ability to finance them.

Implementation

Planning is necessary, but some would say that 10% of the effort is in the planning and 90% is in the implementation. In MikesBikes-Advanced, it is assumed that the outcome of your firm’s decisions depends on the amount of money you commit and on the decisions of the competitor. In reality many more things come into play, such as the quality of the feedback and control systems, the nature of leadership, and the motivation of the people in the organization.

Feedback and Control

In MikesBikes-Advanced, you have feedback at the end of each year of operation. This is the information that allows you to learn and to improve performance in the next year.

Leadership

Leadership can make a huge difference to the performance of an organization. What sort of leadership, by whom, and when, is much more difficult to specify. This is not modeled in MikesBikes-Advanced.

Motivation

Motivation comes from rewards. These rewards can be financial (such as salary, bonuses, cars, etc), or non-financial (such as the satisfaction that comes from the work and being part of a team, the development of a person’s personal skills, etc). A good environment balances these two types for each individual to get the most rewarding environment.

Michael Porter’s Ideas on Strategy

In the 1980’s Michael Porter developed some models for strategic analysis that focused on the five forces presented below. The best industry to be in is one which is most favorable in these areas.

Out of this analysis, he suggests that it makes sense for a Strategic Business Unit to choose one of three “generic” strategies – cost, differentiated, or focus.

The Cost Strategy suggest that one develop the least cost product for a segment. Often this is associated with selling high volumes at lowest price.

The Differentiated Strategy suggests that one develop a unique product and charge a higher margin for it.

The Focus Strategy suggest that one focus on the special needs of a niche segment.

MikesBikes-Advanced is ideally suited to experimenting with these different strategies.

Balanced Scorecard

The term “Balanced Scorecard” was coined by Kaplan and Norton to refer to a framework of financial and non-financial measures which attempts to give a more full and balanced picture of the performance of a firm.

The Balanced Scorecard is composed of four sections:

1. Financial Perspective – e.g. profit, share price.

2. Customer Perspective – e.g. sales, market share, warranty rate

3. Internal Performance Perspective – e.g. efficiency, leadtime

4. Innovation and Learning Perspective – e.g. new products

The idea is that a firm’s progress in implementing a strategy can be represented by improvements on a variety of key measures. These measures must be carefully chosen to be in line with the firm’s strategy and its plan for implementing the strategy.

The Balanced Scorecard approach can be applied in a tiered fashion to construct a performance measurement system for all levels of a company. Many firms use it in their reward/bonus system for their employees.

Measuring Success

Your objective is to create wealth for shareholders and so you will be evaluated on the cumulative change in Shareholder Value that your firm generates.

To see the shareholder value of your firm choose the “Financial Results for All Firms” report from the Key Reports menu.

Being evaluated on shareholder wealth is significantly different from evaluation based on net profit, market share, or earnings per share.

You can read more about this here.

Related Articles

How to Increase Shareholder Value in MikesBikes

Common Mistakes made by Students in MikesBikes

Top 3 Questions Students Ask

MikesBikes Intro (Foundations of Business Simulation) Tutorial Videos

MikesBikes Advanced (Strategic Management Simulation) Tutorial Videos