While all industries have best practices, they are especially prevalent in IT given that so much of the business revolves around data and business processes. Best practices formally represent tested and proven techniques in the form of procedural documentation. In contrast, undocumented procedures are often misleading because stated parameters are not necessarily true or accurate.

Best Practice

Definition – What does Best Practice mean?

A best practice is an industry-wide agreement that standardizes the most efficient way to accomplish a desired outcome. A best practice generally consists of a technique, method or process. The concept implies that if an organization follows best practices, a delivered outcome with minimal problems or complications will be ensured. Best practices are often used for benchmarking and represent an outcome of repeated and contextual user actions.

Abstract

Experiential learning is the basic process of learning through experience and is more specifically defined as learning through reflection on doing. It is akin to forms of Hands-on Learning but does not necessarily involve participants reflecting on the outcomes or products of the process. Experiential learning is distinct from traditional forms of rote or didactic learning, in which the learner plays a comparatively passive role. It is related to, but not synonymous with, other forms of action learning and free-choice learning, along with cooperative learning.[1]

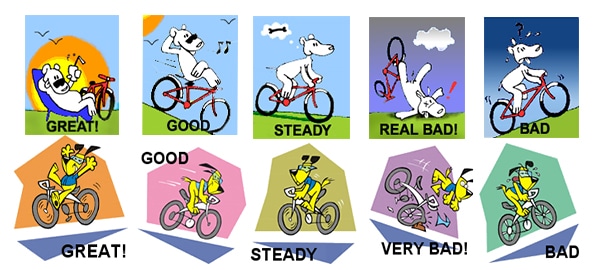

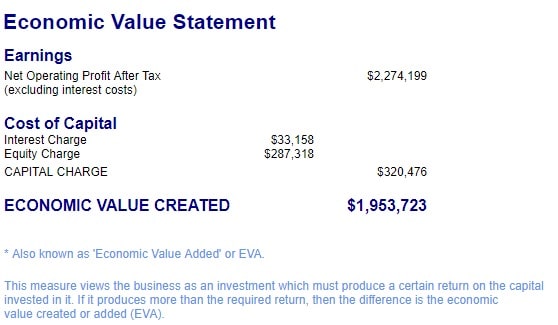

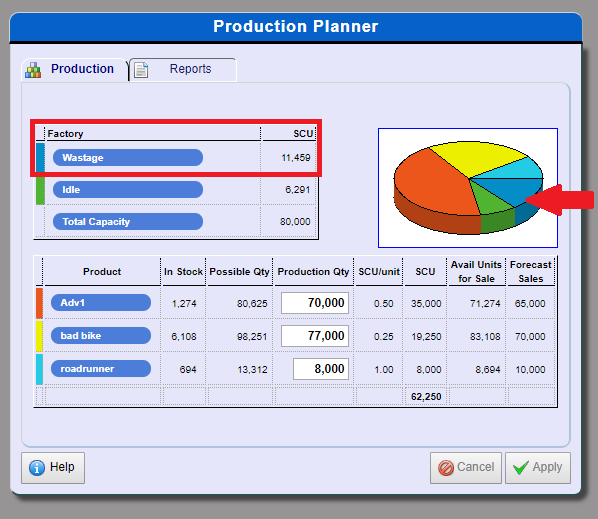

Assessing the effectiveness of the training program in terms of the benefits to the trainees and the company is a crucial element of any experiential learning program. Most assessments are data driven, and traditional tools use tests to measure effectiveness. When it comes to experiential learning programs, it is extremely difficult to gather data that can be used for assessments. This is where analytics come in. When combined with simulations and gamification, experiential training products become a powerhouse of data that can be used to deliver assessments results accurately across cognitive learning, skills affect and objective results.

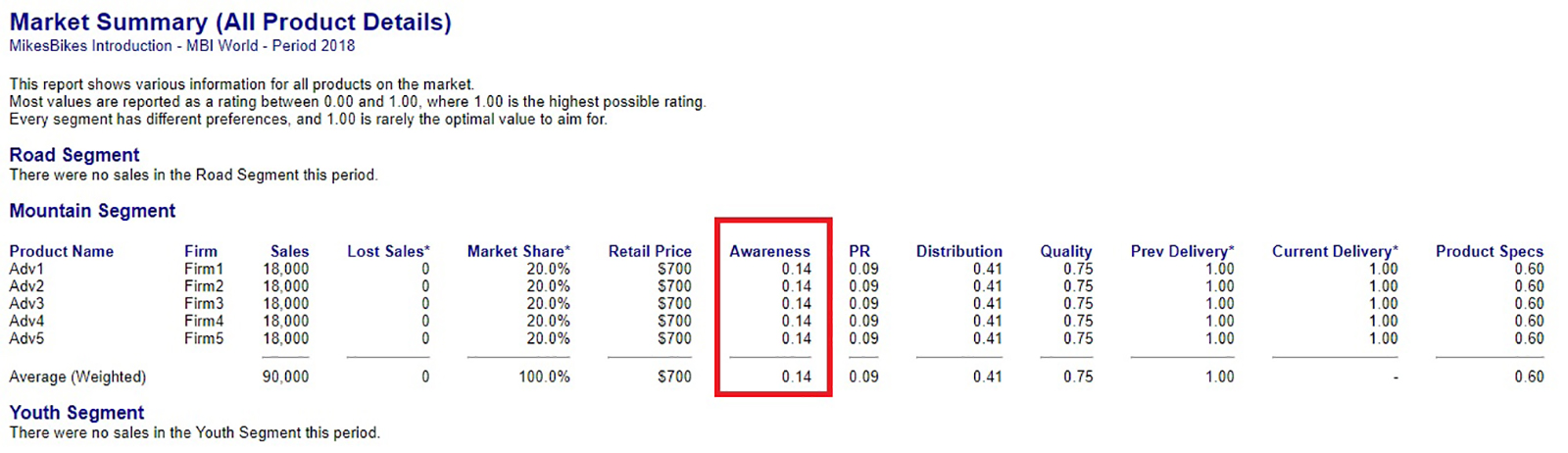

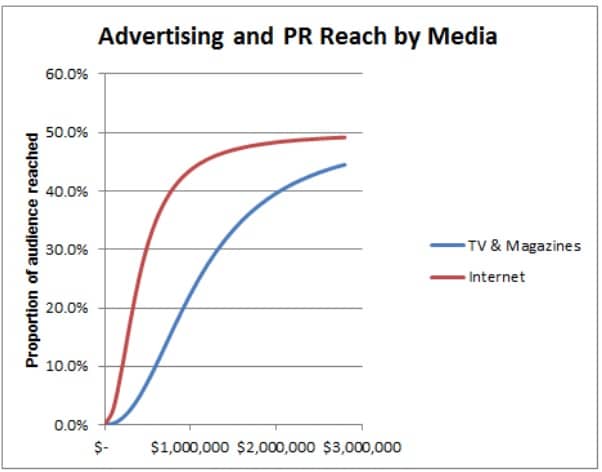

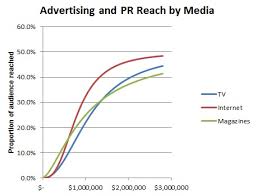

The analytics engines in these simulations (such as MikesBikes) record, analyze and provide a detailed report on the participants’ interaction throughout the simulation. For writing purposes, I have chosen to use the classic Journalism tool called the 5Ws and One H method, starting with What, followed by Why, When, Where, Who — and lastly — How.[2]

What is Experiential Learning

In the words of Lewis and Williams: “In its simplest form, experiential learning means learning from experience or learning by doing. Experiential education first immerses learners in an experience and then encourages reflection about the experience to develop new skills, new attitudes, or new ways of thinking.”[3] The first theories of experiential learning arose in the mid-nineteenth century as attempts to move away from traditional formal education, where teachers simply presented students with abstract concepts, and toward an immersive method of instruction. Students would “learn by doing,” applying knowledge to experience to develop skills or new ways of thinking.

Experiential learning is also built upon a foundation of interdisciplinary and constructivist learning. Experiential methodology doesn’t treat each subject as being walled off in its own room, unconnected to any other subjects. Compartmentalized learning doesn’t reflect the real world, while as the experiential classroom works to create an interdisciplinary learning experience that mimics real world learning.

Similarly, experiential learning is aligned with the constructivist theory of learning in that the outcomes of the learning process are varied and often unpredictable and learners play a critical role in assessing their own learning. How one participant chooses to solve a problem will be different from another, and what one takes away from an experience will be different from the others.

The context for learning is different—learning may not take place in the classroom, and there may be no textbooks or academic texts to study. Finally, the curriculum itself may not be clearly identified—the student may have to identify the knowledge required and then acquire it themselves, reflecting on their learning as they go along.

Experiential learning can also be defined by the qualities it imparts on its learners. Successful experiential learners have a willingness to reorder or alter their conception of a topic. They can reason for themselves and are able to successfully explain their position. They have clarity of purpose with tasks they undertake and the self-management skills necessary to work successfully both alone and in a group.

Experiential learners are aware of the “rules” governing their discipline or mode of operation, but are also open-minded, and able to work with people with different views. Finally, experiential learners are in control of their voice—they can identify the role of emotion in their learning, as well as reflect on how they have come to their new knowledge (Moon, 2004, p. 163).[4]

Why Use Experiential Learning

The open nature of experiential learning means that it can often be difficult to define what is, and is not, an experiential activity. There are many activities that have the potential to be experiential but may not be depending on the execution.

As outlined by Chapman, McPhee, and Proudman:

“Simple participation in a prescribed set of learning experiences does not make something experiential. The experiential methodology is not linear, cyclical, or even patterned. It is a series of working principles, all of which are equally important or must be present to varying degrees at some time during experiential learning. These principles are required no matter what activity the student is engaged in or where the learning takes place” (1995, p. 243).[5]

To define ‘why,’ the following list of characteristics can be used to define the purpose of an activity or method as experiential, including [6]:

- Mixture of content and process: There must be a balance between the experiential activities and the underlying content or theory.

- Absence of excessive judgment: The instructor must create a safe space for students to work through their own process of self-discovery.

- Engagement in purposeful endeavors: In experiential learning, the learner is the self-teacher, therefore there must be “meaning for the student in the learning.”

- Relevance: The learning activities must be personally relevant to the student. Prepared by Michelle Schwartz, Research Associate, for the Vice Provost, Academic, Ryerson University, 2012

- Encouraging the big picture perspective: Experiential activities must allow the students to make connections between the learning they are doing and the world. Activities should build in students the ability to perceive and understand the relationships in complex systems, and then find a way to work within them.

- The role of reflection: Students should be able to reflect on their own learning, bringing “the theory to life” and gaining insight into themselves and their interactions with the world.

- Creating an emotional investment: Learners must be fully immersed in the experience, not merely doing what they feel is required of them. The process needs to engage the learner to a point where what is being learned and experienced strikes a critical, central sweet-spot within the learner.

- The re-examination of values: By working within a space that has been made safe for self exploration, students can begin to analyze and even alter their own values.

- The presence of meaningful relationships: One part of getting students to see their learning in the context of the whole world is to start by showing the relationships between “learner to self, learner to teacher, and learner to learning environment.”

- Learning outside one’s perceived comfort zones: “Learning is enhanced when students are given the opportunity to operate outside of their own perceived comfort zones.” This doesn’t refer just to physical environment, but also to the social environment. This could include, for instance, “being accountable for one’s actions and owning the consequences.”

When and Where: Methods for Assessing Experiential Activities

One of the keys to experiential learning is personalized learning. To enable personalized learning, every program needs to enable a journey through the following phases: Assessment, teaching and learning strategy, and curriculum choice. Experiential learning methodology is highly effective in meeting these requirements to enable personalized learning. It is a radical departure from traditional learning methods and takes the learning beyond the classroom, as the participants set their own learning pace. By combining technology and simulations with experiential learning, companies are making this concept available anytime and anywhere, across multiple devices. This has introduced the concepts of the ‘flipped classroom,’ where the learning goes to the students and not the other way.[7]

Although there are potentially a wide variety of ways to assess when to use experiential activities, the most productive include both external and internal factors. Although all these methods are tied to reflection, the key is helping learners by focusing their learning while also producing an outcome/ product for assessment purposes.

Moon lists 20 or more examples in the Handbook of Reflective and Experiential Learning[8], of which items # 1, 3, 10, 13 and 15 have traditionally been selected as the most effective and popular:

- Maintenance of a learning journal or a portfolio

- Reflection on critical incidents

- Presentation on what has been learnt

- Analysis of strengths and weaknesses and related action planning

- Essay or report on what has been learnt (preferably with references to excerpts from reflective writing)

- Self-awareness tools and exercises (e.g. questionnaires about learning patterns)

- A review of a book that relates the work experience to own discipline

- Short answer questions of a ‘why’ or ‘explain’ nature

- A project that develops ideas further (group or individual)

- Self-evaluation of a task performed

- An article (e.g. for a newspaper) explaining something in the workplace

- Recommendation for improvement of some practice (a sensitive matter)

- An interview of the learner as a potential worker in the workplace

- A story that involves thinking about experiencing learning

- A request that students take a given theory and observe its application in the workplace

- An oral exam

- Management of an informed discussion

- A report on an event in the work situation (ethical issues)

- Account of how discipline issues apply to the workplace [9]

- An identification of and rationale for projects that could be done in the workplace.

Who Uses Experiential Learning

Instructors and participants like to use experiential learning for simulations. Simulations use real life scenarios that depict several challenges that a participant will eventually face after the course completion. It is only natural that mistakes happen during learning; using simulations is like taking kids to a playground, and getting them to have fun, try new things and learn in a safe controlled environment. By moving beyond theory to the realm of “learning by doing,’ the learner gets a first-hand experience of practicing what has been taught. This plays a crucial role in retaining concepts and ideas.

How to Use the Learning Portfolio

There are very few learning methods that can have a dramatic impact on the participant’s mindset. Experiential Learning is one of them. Management guru Henry Mintzberg pointed out long ago that leadership, like swimming, cannot be learned by reading about it. The high focus on collaboration and learning from each other benefits the participant as it increases engagement. On the other hand, since the participant is immediately involved in the problem-solving activity or event, the level of ownership of the outcome is high.

Of these methods, Qualters[10] focuses on using the learning portfolio as one of the most comprehensive methods of assessing experiential learning, with its purpose being to “strongly determine the themes of the reflective narrative, as well as the types of documentation or evidence selected in the appendices.” A planning rubric representing this can be a table with three columns—purpose, theme, and evidence—and the content of these columns can be quite broad. John Zubizarreta[11] proposes a simple model for a learning portfolio with three fundamental and interrelated components:

1. Reflection 2. Documentation 3. Collaboration.

Learning portfolios are distinguished from standard professional portfolios through their inclusion of a reflection component. It therefore becomes more than just “a showcase of student materials,” and instead becomes a “purposefully designed collection connected by carefully thought out structured student reflections.”

To plan a learning portfolio project, Zubizarreta[12] provides a short rubric that asks instructors to first identify the purpose of the portfolio, and then answer the following questions:

- What kind of reflective questions should students address?

- What kinds of evidence or learning outcomes would be most useful?

- How will students engage in collaboration and mentoring during the process?

Beyond assessing student learning, well-constructed portfolios can be used for accreditation, university-wide outcome assessment, and to document and understand the learning process at both the level of course and program.

How to Measure and Assess Experiential Learning

Measurement and assessment are very often the most integral parts of the experiential learning process. It provides a basis for participants and instructors alike to confirm and reflect on the learning and growth that has and is occurring. Further, proper assessment methods engender a “reflective process that ensures continued growth long after specific learning opportunities have been completed.

Without the appropriate assessment tool, such as a self-assessment, the educator might not ever realize that significant learning occurred. Therefore, classroom educators should search for assessment techniques that measure more than just the ability to remember information. [13]. The assessment of experiential activities presents a unique problem to instructors. Because in experiential activities the means are as important as the ends, “it is important to look at assessment as more than outcome measurement.

While outcomes are important to measure, they reflect the product of assessment, not a complete assessment cycle” (Qualters, 2010, p. 56). It is therefore necessary to devise unique assessment methods to measure success in both the process and the product—each area requires separate learning outcomes and criteria (Moon, 2004, p. 155).

Summary

I believe there are eight reasons why experiential learning is very likely to become the future of learning: [14]

- Accelerates the learning process

- Provides a relatively safe and secure learning environment

- Bridges the gap between learning theory and practice

- Produces demonstrable mindset changes

- Increases participant engagement levels

- Delivers exceptional Return on Investment or payback

- Provides measurable and accurate assessment results

- Enables personalized learning.

Everybody has one’s own model of learning, some of them more effective than others. In this article, I tried to convince interested readers to become enablers of a powerful learning experience which will help build a learning context by experiencing things. The need is urgent; the time is now.

The question is: Are you ready?

For references and footnotes view the PDF copy here: Best Practices in Experiential Learning by Frank Voehl

This article is written by Frank Voehl. Frank is an Innovation Coach and expert in the application of the business improvement tools and innovation methods to public and private organizations, including city, county, community government, and non-profit operations. He is also a Grand Master Black Belt Instructor in Lean Six Sigma and Performance Management. He’s a noted author and series editor of over 30 books and hundreds of business management and improvement articles and technical papers. He also provided input on the original design of the Malcolm Baldrige National Quality Award, and facilitated its crossover to other nations and regions, including the Bahamas, South America, Europe and the Czech Republic.