“Success does not consist in never making mistakes, but in never making the same one a second time.”

– George Bernard

Three of the most common mistakes we see MikesBikes Advanced users make are:

- Misunderstanding the Importance of Reaching the Right Customers

- Failed Development Projects

- Excessive Stock on Hand

Mistake#1: Misunderstanding the Importance of Reaching the Right Customers

Not understanding this can be a costly mistake as it often leads to incorrectly assigning your marketing mix. This can have a negative impact on the demand for your products and can also lead to overspending. Meaning your firm’s profitability is at risk!

How do you know if you are spending your marketing budget inefficiently? Follow through this section, it will show you how to efficiently allocate your marketing budget.

There are three aspects to a marketing budget within MikesBikes-Advanced:

- Branding

- Advertising

- PR

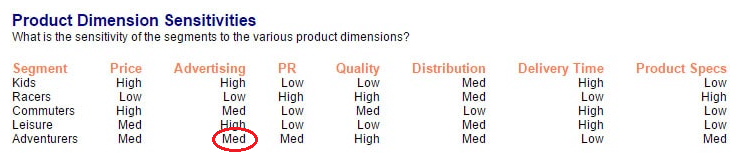

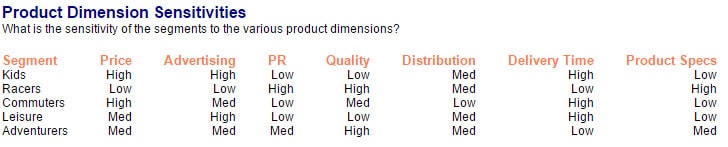

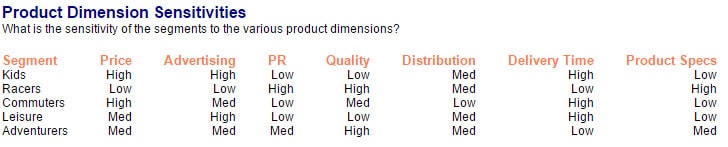

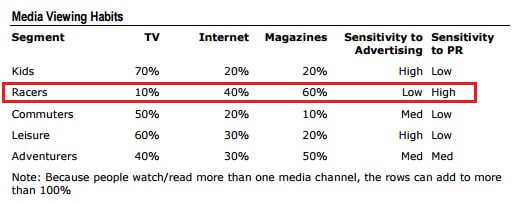

Each market segment is sensitive to different dimensions. View the Market Segment Scenario Information report.

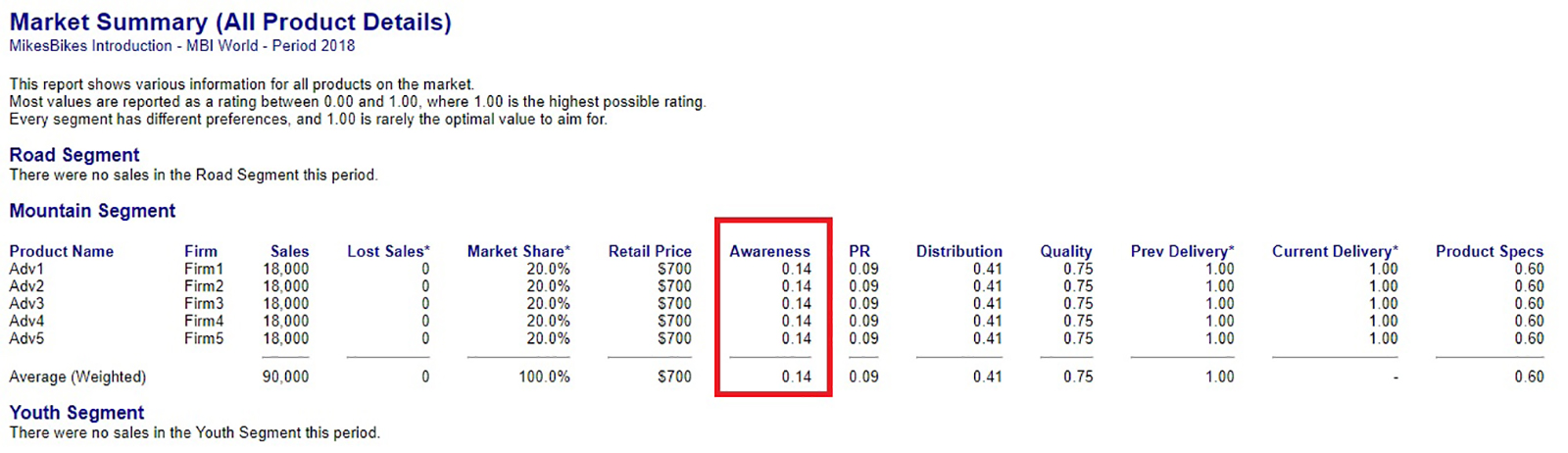

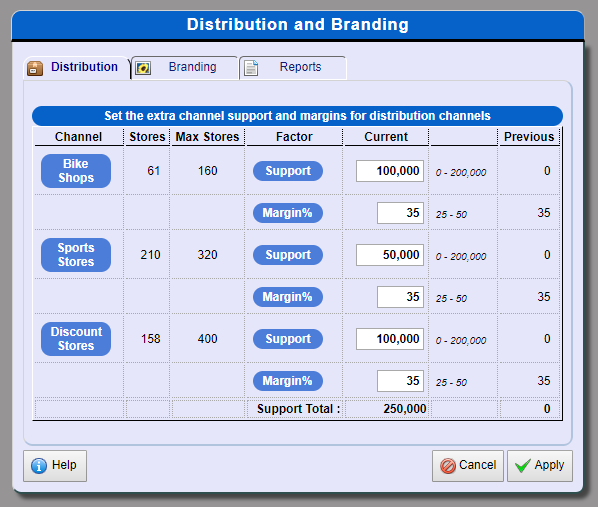

Branding and Advertising work together to improve your firm’s Awareness rating (see Market Summary) whereas your PR index is only influenced by PR spend. Branding promotes your firm’s brands and will influence all of your product’s awareness whereas advertising is product specific.

How do I interpret this Product Dimension Sensitivities graph?

The best way to explain it is through an example. If we take the Racers segment we see it has a low sensitivity to Advertising and a high sensitivity to PR. This means that an increase to our Racers bikes’ PR index (see Market Summary report) is going to have a larger increase to our sales volume than a change to our Awareness rating.

I’ve now chosen which dimensions of marketing I want to focus on, what next?

Branding impacts the awareness of every product you have and is valuable if you have several products within the market. This is a straight forward decision; simply enter in the amount you want to invest into branding.

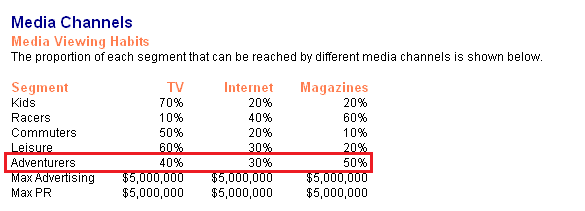

Whereas Advertising and PR decisions require you to choose media channels based upon the media types’ reach and the media viewing habits of each market segment. There are three media choices to develop your marketing mix on: Television, Internet and Magazines.

There are two substantial sources of information you can use to determine your optimal advertising mix for a given advertising spend.

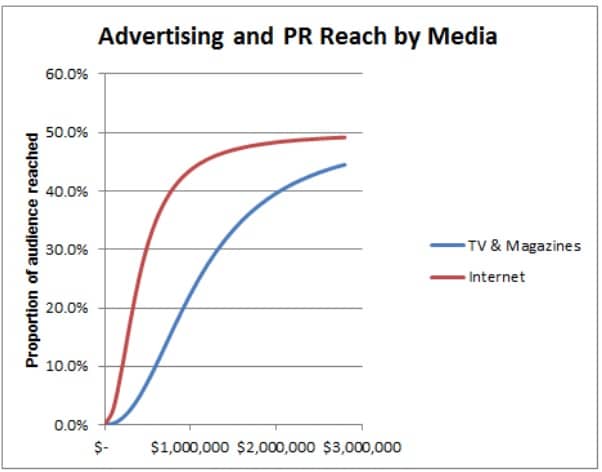

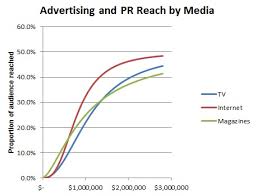

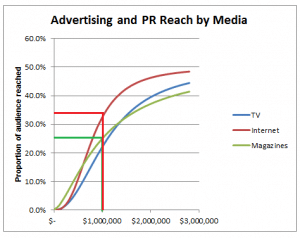

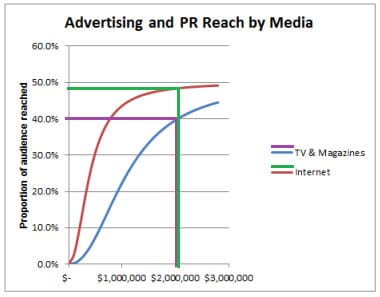

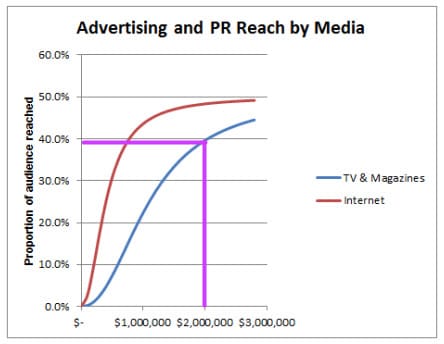

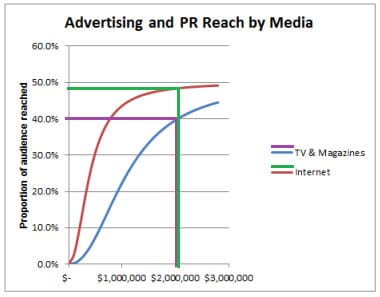

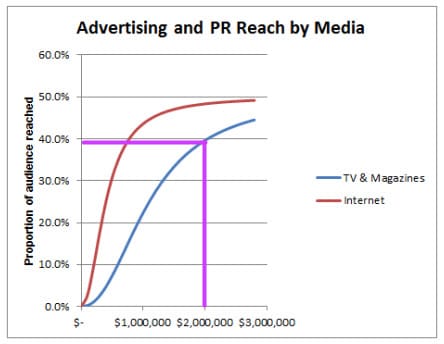

Each media type can reach a given proportion of its audience for a given investment. This is shown within the Advertising and PR Reach by Media graph below (this can be found within the Market Segment Scenario Information report).

The best way to explain this would be to provide an example. A $2 million spent on TV or Magazine advertising (purple line) could reach around 40% of the potential TV or Magazine audience. Whereas $2 million spend on Internet advertising (green line) could reach 49% of potential Internet audience.

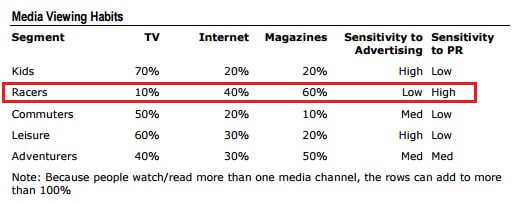

However, you also have to consider who uses each media channel. This is where we look at the Media Viewing Habits:

The table shows us that 10% of the Racers market watch TV, 40% engage within the use of the Internet regularly, and 60% read magazines. You use this information with the reach curves to calculate the percentage of the market segment you’re actually reaching.

Okay. I get that, but how do I tell if my MikesBikes-Advanced marketing budget is ineffective?

We have prepared for you two examples. One is a bad example of a marketing spend and the other is a good example. Through these examples this article will walk you through how to calculate an effective spend.

Bad example:

“I have a $2 million budget. I see most people read magazines in the Racers Market and they’re sensitive to PR so I’m going to spend this $2 million on magazines within the Racers market”

Sound logical, right? No. Far from it.

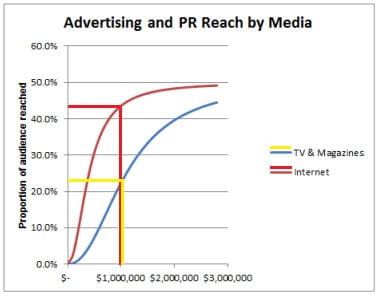

It is correct that the Racers segment is highly sensitive to PR. It is also correct that 60% of the Racers segment read magazines however it is ignoring the effective reach of each media type. Let’s look at the audience reached and calculate this ‘real reach’ for this bad marketing expenditure:

From the above curve we can see that a $2 million spend on magazines would reach approximately 38%. 60% of the Racers segment read magazines regularly. So our $2 million spend would reach 38% x 60% = 22.8%

So from that example, you might think that it’s best to allocate your budget completely on Magazines, but if we come up with a good Marketing Mix, we might be able to do better.

Good Example:

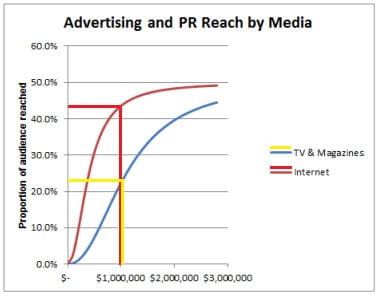

“I’ve got $2 million to spend on marketing this Racers product directly. I see the Racers market is sensitive to changes in PR so I’m going to fund my marketing budget into PR for this bike. I also see that 60% of this segment view magazines but 40% are on the internet regularly. Also, while racers segment mostly reads magazines; the internet has a higher reach so I will look into investing in both.”

Let’s look at how this logic plays out.

If we spend $1 million on Internet, we could reach approximately 44% of Internet viewers. 40% of the Racers segment is reachable via Internet advertising, meaning we could reach approximately 40% x 44% = 17.6% of the Racer segment.

Also spending $1 million on Magazines, we could reach approximately 23% of Magazine Viewers. So we could reach approximately 23% x 60% = 13.8% of the Racer segment.

Together, our $2 million budget (half spent on Internet and half on Magazine) would reach approximately 31.4% of the Racer segment. This is clearly a better use of our PR budget than bad example given which only reached 22.8% of the Racers segment.

As you can see, with the same budget, but a different allocation towards each media channel can make a huge difference in the amount of consumers you can reach.

This is only an example of good and bad marketing mixes. This is far from the best mix you can make. We suggest playing around on different Marketing Mix and see what works best for your strategy and budget.

Mistake#2: Failed Product Development Projects

You want to get product development projects right the first time as this can be a costly mistake. It can mean either your Unit Prime Cost is higher than you want and/or your specifications are not as you wanted resulting in a lower demand for your product if they are wrong.

Why did my project development fail and how do I fix it?

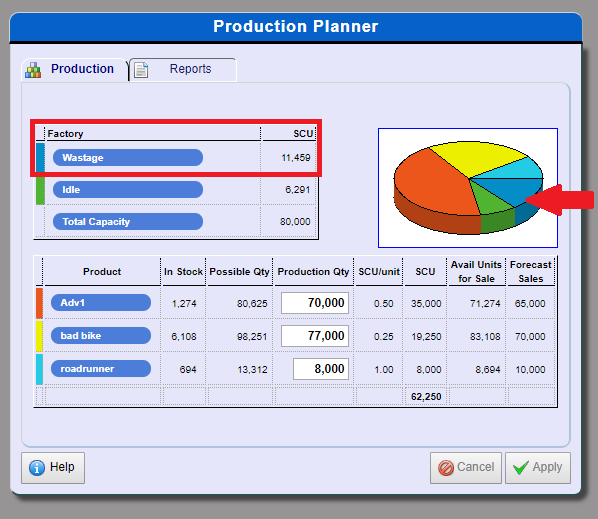

Mistake#3: Excessive Closing Inventory

Too much inventory can cause cost your firm in Finished Goods Holding Cost, this can be a needless cost if you are able to predict next year’s demand more accurately.

There are two ways on how you can resolve this:

- Start by making Accurate Sales Forecast based on last year’s Actual Sales and adjust production based on this forecast and your current stock levels.

- Another step you can take to resolve this is to conduct a Product Modification to extinguish excess stock.

I still need help!

If you have any questions or would like to discuss anything further from what has been mentioned, please feel free to get in touch with us by clicking here.